Friday, October 29, 2010

Today's IPO looks intresting - GAGA - Delayed open

Le Gaga's (GAGA) IPO Prices at High End of Expected Range

Oct 29 at 09:22

Profile hits: QU2

Earlier this morning, GAGA's 10.9 mln share IPO priced at the high end of

its expected range, coming in at $9.50 vs. the $7.50-$9.50 expected range,

to raise total gross proceeds of $103 mln. The lead underwriters on the deal

were BofA Merrill Lynch and UBS... GAGA is one of the largest greenhouse

vegetable producers in China, selling over 100 varieties of vegetables, such as

cabbage, tomatoes, peppers, broccoli, potatoes, and cucumbers, to name a few.

The co markets to wholesalers (55.4% of sales), institutional customers (33.7%),

and supermarket chains (10.8%) in China and Hong Kong. Its top customers include

Wal-Mart, and the country's largest grocery chains, including Wellcome,

ParknShop, and Vanguard. GAGA operates 16 farms with an aggregate area of 1,257

hectares in the Chinese provinces of Fijian, Guangdong, and Hebei. Fourteen of

these farms are located near its target markets in southern China... For the

three months ended June 30, 2010, GAGA's revenue grew roughly 55% to RMB 83.3

mln. Unfortunately, the co's strong sales growth was undermined by a 81% surge

in the cost of inventories sold, to RMB 79.3 mln. This significant increase

was mostly driven by higher farmland operating expenses. Consequently, GAGA's

operating margins dove to 28.3% from 52.8%, and operating income slid 17%

year-over-year to RMB 23.6 mln... Based on the success of prior

consumer-oriented, China based IPOs (CCSC & MCOX), GAGA's strong pricing does

not come as a surprise. GAGA's story isn't completely "clean" due to its eroding

margins as it builds more greenhouses, but interest should remain high based on

its growth potential and investors' strong appetite for emerging market IPOs.

Oct 29 at 09:22

Profile hits: QU2

Earlier this morning, GAGA's 10.9 mln share IPO priced at the high end of

its expected range, coming in at $9.50 vs. the $7.50-$9.50 expected range,

to raise total gross proceeds of $103 mln. The lead underwriters on the deal

were BofA Merrill Lynch and UBS... GAGA is one of the largest greenhouse

vegetable producers in China, selling over 100 varieties of vegetables, such as

cabbage, tomatoes, peppers, broccoli, potatoes, and cucumbers, to name a few.

The co markets to wholesalers (55.4% of sales), institutional customers (33.7%),

and supermarket chains (10.8%) in China and Hong Kong. Its top customers include

Wal-Mart, and the country's largest grocery chains, including Wellcome,

ParknShop, and Vanguard. GAGA operates 16 farms with an aggregate area of 1,257

hectares in the Chinese provinces of Fijian, Guangdong, and Hebei. Fourteen of

these farms are located near its target markets in southern China... For the

three months ended June 30, 2010, GAGA's revenue grew roughly 55% to RMB 83.3

mln. Unfortunately, the co's strong sales growth was undermined by a 81% surge

in the cost of inventories sold, to RMB 79.3 mln. This significant increase

was mostly driven by higher farmland operating expenses. Consequently, GAGA's

operating margins dove to 28.3% from 52.8%, and operating income slid 17%

year-over-year to RMB 23.6 mln... Based on the success of prior

consumer-oriented, China based IPOs (CCSC & MCOX), GAGA's strong pricing does

not come as a surprise. GAGA's story isn't completely "clean" due to its eroding

margins as it builds more greenhouses, but interest should remain high based on

its growth potential and investors' strong appetite for emerging market IPOs.

NG looks higher

ARGUMENTS - Tim Kelleher: technical fundamentals

Tim Kelleher: takeover chatter STRONG SECTOR - TRENDS - TRAPS - TRADEABILITY

Tim Kelleher: takeover chatter STRONG SECTOR - TRENDS - TRAPS - TRADEABILITY

Bank of America reportedly pushed risky products on customers, NY Post says

In the midst of the financial meltdown, a former Bank of America (BAC)

employee claims the firm "aggressively" pushed complex derivatives products on

customers without warning them of the risks associated with them. In a letter to

SEC chief Mary Schapiro, the former employee claims the bank told investors the

products were "extremely conservative," the New York Post reports. [Reference

Link]:[http://www.nypost.com/p/news/business/informer_bofa_hawked_risky_deals_9A

R9iRb1nf2ndz6F4nMO0O]

employee claims the firm "aggressively" pushed complex derivatives products on

customers without warning them of the risks associated with them. In a letter to

SEC chief Mary Schapiro, the former employee claims the bank told investors the

products were "extremely conservative," the New York Post reports. [Reference

Link]:[http://www.nypost.com/p/news/business/informer_bofa_hawked_risky_deals_9A

R9iRb1nf2ndz6F4nMO0O]

Today's Calendar

Friday, October 29, 2010

Economic

08:30 US Advance Q3 GDP/Price Index/Personal Consumption/Core PCE; Canada Aug GDP

09:45 US Oct Chicago Purchasing Manager Index

10:00 US Oct University of Michigan Confidence, Oct NAPM-Milwaukee

Events

Trades Ex-dividend: SEP $0.44.

Earnings

Before the Open: ALE, LNT, AEE, AXL, AGP, AON, AIV, ACI, B, BPO, CSE, CVX, CI, SUR, CMCO, CMC, CNX, CEG, D, UFS, DTE, EIX,EL, GHM, HSIC, HMSY, IPG, ITT, LPNT, MGLN, MDC, MRK, MEA, NDAQ, NWL, NI, POM, PNM, PGN, PFS, COL, RUTH, SHPGY, SNE, WBC.

Thursday, October 28, 2010

MSFT trades at its 200 day ma resitance of 27 post earnings

MSFT offered good short scalps at its 200 may resistance levels after the headline in the post market...

10/28 | 16:11 | Q-MSFT | DJ | Microsoft Backs FY11 Oper Expenses $26.9B-$27.3B >MSFT

10/28 | 16:11 | Q-MSFT | DJ | Microsoft 1Q EPS 62c >MSFT

10/28 | 16:11 | Q-MSFT | DJ | Microsoft 1Q Rev $16.2B >MSFT

BP APC RIG in motion up - HAL lower

Commission says Halliburton cement may have contributed to blowout

Oct 28 at 13:41

Profile hits: NONE

Oct 28 at 13:41

Profile hits: NONE

Today's Trade - BAC Short

Short BAC on the gap up this AM at 11.64. Covered some here at 11.51. Looks lower.

Arguments - TRENDS TRAPS TRADEABILTY - CONTRA on yesterdays upgrade. Removed from Merrill's best idea list. Relative weakness.

Arguments - TRENDS TRAPS TRADEABILTY - CONTRA on yesterdays upgrade. Removed from Merrill's best idea list. Relative weakness.

Today's Calendar

Friday, October 29, 2010

Economic

08:30 US Advance Q3 GDP/Price Index/Personal Consumption/Core PCE; Canada Aug GDP

09:45 US Oct Chicago Purchasing Manager Index

10:00 US Oct University of Michigan Confidence, Oct NAPM-Milwaukee

Events

Trades Ex-dividend: SEP $0.44.

Earnings

Before the Open: ALE, LNT, AEE, AXL, AGP, AON, AIV, ACI, B, BPO, CSE, CVX, CI, SUR, CMCO, CMC, CNX, CEG, D, UFS, DTE, EIX,EL, GHM, HSIC, HMSY, IPG, ITT, LPNT, MGLN, MDC, MRK, MEA, NDAQ, NWL, NI, POM, PNM, PGN, PFS, COL, RUTH, SHPGY, SNE, WBC

Wednesday, October 27, 2010

PLD Prices at 12.30 Trading higher in the pre market at 12.80

Filings, Offerings, Pricings and IPOs

Oct 27 at 07:59

Profile hits: QU2

Filings: -- JinkoSolar Holding (JKS) filed for a 3.5 mln share ADS

offering; 2 mln ADS are being offered by the co and 1.5 mln are being offered by

selling shareholders. -- RadiSys (RSYS) filed for a $100 mln mixed shelf

offering. -- GTX (GTXI) filed for a common stock offering for an indeterminate

amount. -- Senesco (SNT) filed for a $25 mln mixed shelf offering. -- Pacific

Ethanol (PEIX) filed for a ~99.12 mln share common stock offering by selling

shareholders. -- Tsakos Energy (TNP) filed for a ~6.72 mln share common stock

offering. Offerings: -- Broadcom (BRCM) announced a $600 mln sr notes

offering. Pricings: -- ProLogis (PLD 12.63) priced an 80 mln share common stock

offering at $12.30/share. IPOs: -- Pacific Biosciences (PACB), a developer,

manufacturer and marketer of integrated platforms for genetic analysis, priced

its 12.5 mln share IPO at $16.00/share, at the midpoint of the $15-$17/share

expected range.

Oct 27 at 07:59

Profile hits: QU2

Filings: -- JinkoSolar Holding (JKS) filed for a 3.5 mln share ADS

offering; 2 mln ADS are being offered by the co and 1.5 mln are being offered by

selling shareholders. -- RadiSys (RSYS) filed for a $100 mln mixed shelf

offering. -- GTX (GTXI) filed for a common stock offering for an indeterminate

amount. -- Senesco (SNT) filed for a $25 mln mixed shelf offering. -- Pacific

Ethanol (PEIX) filed for a ~99.12 mln share common stock offering by selling

shareholders. -- Tsakos Energy (TNP) filed for a ~6.72 mln share common stock

offering. Offerings: -- Broadcom (BRCM) announced a $600 mln sr notes

offering. Pricings: -- ProLogis (PLD 12.63) priced an 80 mln share common stock

offering at $12.30/share. IPOs: -- Pacific Biosciences (PACB), a developer,

manufacturer and marketer of integrated platforms for genetic analysis, priced

its 12.5 mln share IPO at $16.00/share, at the midpoint of the $15-$17/share

expected range.

Today's Calendar

Economic

06:00 Brazil Oct Consumer Confidence

08:30 US Sept Durable Goods Orders

10:00 US Sept New Home Sales

10:30 DoE Crude Oil/Gasoline/Distillate Inventories

13:00 US Treasury's 5-yr note auction

Events

07:00 MBA Mortgage Applications. Trades Ex-dividend: AOS $0.21, CAG $0.23, LNT $0.395, COP $0.55, COST $0.205, KMP $1.10, NI $0.23, PNR $0.19, TYC $0.21.

Earnings

Before the Open: ABD, ACXM, AYE, ARLP, ARGN, ARW, AUO, ADP, AVY, BWA, EAT, CP, CMCSA, COP, CFR, DPS, ELN, EEFT, FSRV, FBC, GD, HERO, HES, IACI, IP, LAZ, LM, LECO, LOJN, MKTX, MSO, MWV, NM, NOR, NOC, NYB, ODFL, OC, PTI, PFCB, PX, PG, PEG, RDWR, RES, SAP, SVVS, SCG, SEE, SSW, SXT, SLAB, SO, SPNC, S, TASR, JNY, MDCO, TMO, UMC, USAP, VPHM, VSI, WAB, WHR, WTFC, WNS. After the Close: ACE, AEA, AFFX, ATAC, AEM, AIQ, AB, ALL, ARII, AMP, ARRS, AHL, AIZ, AVB, BEZ, BYI, BEC, BDN, BKI, CACI, CDNS, CWT, CAVM, CHH, CINF, CYH, CCI, DRE, DRCO, WIRE, ENTR, EFX, EQR, ESRX, DAVE, FVE, FLEX, FLS, FMC, FTI, GMR, GG, GSIC, HBI, HGR, HLX, HRC, IDCC, IFSIA, ICO, IPCM, IRBT, ITRI, KAI, KEG, KEX, LAD, LOGI, LOGM, LOOP, LSI, MANT, MDAS, MTH, MERU, MORN, NEWP, NSC, OMCL, OTEX, ORLY, OFIX, OI, PLXS, POWI, QTM, QDEL, RA, RRC, O, RNR, RYL, SGMO, SIGI, SFN, SFLY, SKX, FIRE, SRCL, RGR, SUNH, SXL, SPN, SYMC, TER, TMK, CLUB, TRN, TQNT, TYL, UHS, V, VISN, WRE, WLL, WSH.

Tuesday, October 26, 2010

IBM Board Approves Quarterly Cash Dividend

ben: IBM snuck a buyback in their dividend story

Steven from North JErsey: circuit breaker haly

ben: way late now

IBM Board Approves Quarterly Cash Dividend

Oct 26 at 10:24

Profile hits: QU1

Authorizes $10.0 Billion for Stock Repurchase

ARMONK, N.Y.--(BUSINESS WIRE)-- The IBM (NYSE: IBM) board of directors

today declared a regular quarterly cash dividend of $0.65 per common share,

payable December 10, 2010 to stockholders of record November 10, 2010.

With the payment of the December 10 dividend, IBM will have paid

consecutive quarterly dividends every year since 1916.

The board today also authorized $10 billion in additional funds for use

in the company's stock repurchase program. IBM said it will repurchase shares on

the open market or in private transactions from time to time, depending on

market conditions.

This amount is in addition to approximately $2.3 billion remaining at

the end of September 2010 from a prior authorization. With this new

authorization, IBM will have approximately $12.3 billion for its stock

repurchase program. IBM expects to request additional share repurchase

authorization at the April 2011 board meeting.

Samuel J. Palmisano, IBM chairman, president and chief executive officer

said "IBM's higher value, higher margin business strategy has enabled the return

of $91 billion since 2003 to our shareholders through share repurchases and

dividends. We've done this while investing to bring new products and services to

market, and expanding IBM's business into new, emerging markets."

Steven from North JErsey: circuit breaker haly

ben: way late now

IBM Board Approves Quarterly Cash Dividend

Oct 26 at 10:24

Profile hits: QU1

Authorizes $10.0 Billion for Stock Repurchase

ARMONK, N.Y.--(BUSINESS WIRE)-- The IBM (NYSE: IBM) board of directors

today declared a regular quarterly cash dividend of $0.65 per common share,

payable December 10, 2010 to stockholders of record November 10, 2010.

With the payment of the December 10 dividend, IBM will have paid

consecutive quarterly dividends every year since 1916.

The board today also authorized $10 billion in additional funds for use

in the company's stock repurchase program. IBM said it will repurchase shares on

the open market or in private transactions from time to time, depending on

market conditions.

This amount is in addition to approximately $2.3 billion remaining at

the end of September 2010 from a prior authorization. With this new

authorization, IBM will have approximately $12.3 billion for its stock

repurchase program. IBM expects to request additional share repurchase

authorization at the April 2011 board meeting.

Samuel J. Palmisano, IBM chairman, president and chief executive officer

said "IBM's higher value, higher margin business strategy has enabled the return

of $91 billion since 2003 to our shareholders through share repurchases and

dividends. We've done this while investing to bring new products and services to

market, and expanding IBM's business into new, emerging markets."

Monday, October 25, 2010

BAC triggers short entries for the 3rd time this AM

As mentioned in earlier post and today's AM meeting, BAC is suspect to trade lower. Incredible relative weakness all AM in a strong market

Sunday, October 24, 2010

Saturday, October 23, 2010

Barrons Exposes Massive PUT Exposure in BAC!

Please refer to our earlier post on Friday Oct 22 were Ben and I exposed options activity..We have been short the stock since early last week from above 12....

Barron's(10/25) Could BofA Shares Fall To $2.50?

Oct 23 at 00:03

Profile hits: NONE

By Steven M. Sears

(From BARRON'S)

Bank of America's mortgage woes could continue to depress the banking

giant's stock for years to come. At least that's what some high-level investors

are telling us through their trading activity.

Just a few weeks ago, Bank of America (ticker: BAC) seemed ready to emerge

from that special funk that holds back stocks with complicated investment

stories, but now the bank's future prospects are a center-stage concern amid

unease about the legality of many home foreclosures, as well as the asset

quality of its mortgages.

"Bank of America is the market's whipping boy. It is the poster child for

the foreclosure mess," said a senior trader at a major firm, requesting

anonymity.

In the options market, where sophisticated investors reveal their

thoughts, a dour picture is emerging.

On Friday, an investor whose identity is unknown bought 160,000 November

$10 puts paying 12 cents a contract when the stock was at $11.48. The

order was shopped by GFI, an interdealer broker, according to a trader who was

called about the order. The massive put-purchase trade attracted attention

across the stock, options and bond markets, and set tongues wagging about why

someone would buy puts equivalent to 16 million shares that expire Nov. 19. The

trade was probably linked with stock, and serves to hedge a major position.

According to trading patterns, some options traders are betting that

BofA's $ 11 stock could fall to $2.50 by 2013. Indeed, its $2.50 puts that

expire in January 2013 have been actively traded since Tuesday. Investors buy

put contracts if they think the stock will fall in value.

In the current session, the action has extended to $2.50 puts that

expire in January 2012. These puts are probably little more than speculative

trades, but they are telltale signs of the depth of concern that many investors

have about BofA's stock.

The story is also told by changes in the outstanding positions.

Bank of America's November $12 puts, which increase in value as the

stock declines ever deeper below $12, remain unusually active. Open interest

on the November $12 puts increased Tuesday by almost 70,000 contracts,

bringing total open interest to about 360,000 contracts.

Indeed, put options remain unusually active across all strikes and

expirations listed for Bank of America.

In the latest round of allegations against the bank company, Pimco,

BlackRock (BLK), and the Federal Reserve Bank of New York have essentially

accused Bank of America of selling them $47 billion of mortgage-backed

securities laden with enough bad mortgages to diminish the profitability of the

investments. (For one analyst's take on this situation, see the second item in

this week's Market Watch sampling, page M11.)

True or not, such accusations are taken seriously in the markets because

institutional investors always fear banks use their advantages as major dealers

who control the markets to unload bad financial products that they themselves do

not want to inventory. Even worse, this accusation against Bank of America

resurrects lingering investor fears that Bank of America's 2008 purchase of

Countrywide Financial for $4.1 billion has coupled the fortunes of the

Charlotte, N.C., bank to a hard-to-evaluate financial mess.

While initial media reports indicate that BofA has been asked to buy back

up to $47 billion in mortgage securities, a person close to the money managers

said that was premature. "We want to know if improper loans were securitized,"

this person said. "At this point, it is just basic due diligence."

So far, BofA has reportedly rebuffed requests that it repurchase the

securitized mortgages. But that counts for little in the markets. Until the

matter is settled, Bank of America will trade like a litigation stock. News

headlines will heavily influence options and stock trading. The next few weeks

could be tough even if the speculators playing for a snapback in the stock price

manage to make some money.

In the parlance of trading, Bank of America has "headline risk." The stock

will make sharp moves in reaction to the headlines on news stories. And the

headlines will come. The banking industry is accused of relying on shoddy home-

foreclosure practices. Congress is planning hearings, which many in the markets

know -- often from personal experience -- are little more than populist witch-

hunts good for intraday trading volatility.

Inquiries with much more impact could come in the form of investigations

by state attorneys general trying to determine if mortgage lenders violated

state laws.

Already, many sophisticated investors have reached a guilty verdict on

Bank of America as evidenced by unusually robust trading in Bank of America's

bearish options. On Tuesday, when the bank reported disappointing earnings,

1.027 million options, or more than three times average daily volume, traded. On

Wednesday, trading volumes remained 1.6 times normal and investor pessimism was

still robust, suggesting that Mortgagegate still compels more investors and

traders to prepare for Bank of America's stock to continue to slide down the

proverbial slope of hope reserved for Wall Street's most troubled companies.

Bank of America's stock has declined 22% this year, compared with a 9%

decline for JPMorgan Chase (JPM) and a 24% gain for Citigroup (C), the financial

sector's former problem child.

With Bank of America's stock trading at a 52-week low, investors continue

to stockpile defensive put options that will increase in value if BofA's stock

falls further. The November $10 and $12 puts remain widely held, and in

demand. Investors are defraying the price of buying puts by selling bullish

calls. They are using money received from selling calls -- an indication the

stock is not expected to rise -- to buy bearish puts.

---

Barron's(10/25) Could BofA Shares Fall To $2.50?

Oct 23 at 00:03

Profile hits: NONE

By Steven M. Sears

(From BARRON'S)

Bank of America's mortgage woes could continue to depress the banking

giant's stock for years to come. At least that's what some high-level investors

are telling us through their trading activity.

Just a few weeks ago, Bank of America (ticker: BAC) seemed ready to emerge

from that special funk that holds back stocks with complicated investment

stories, but now the bank's future prospects are a center-stage concern amid

unease about the legality of many home foreclosures, as well as the asset

quality of its mortgages.

"Bank of America is the market's whipping boy. It is the poster child for

the foreclosure mess," said a senior trader at a major firm, requesting

anonymity.

In the options market, where sophisticated investors reveal their

thoughts, a dour picture is emerging.

On Friday, an investor whose identity is unknown bought 160,000 November

$10 puts paying 12 cents a contract when the stock was at $11.48. The

order was shopped by GFI, an interdealer broker, according to a trader who was

called about the order. The massive put-purchase trade attracted attention

across the stock, options and bond markets, and set tongues wagging about why

someone would buy puts equivalent to 16 million shares that expire Nov. 19. The

trade was probably linked with stock, and serves to hedge a major position.

According to trading patterns, some options traders are betting that

BofA's $ 11 stock could fall to $2.50 by 2013. Indeed, its $2.50 puts that

expire in January 2013 have been actively traded since Tuesday. Investors buy

put contracts if they think the stock will fall in value.

In the current session, the action has extended to $2.50 puts that

expire in January 2012. These puts are probably little more than speculative

trades, but they are telltale signs of the depth of concern that many investors

have about BofA's stock.

The story is also told by changes in the outstanding positions.

Bank of America's November $12 puts, which increase in value as the

stock declines ever deeper below $12, remain unusually active. Open interest

on the November $12 puts increased Tuesday by almost 70,000 contracts,

bringing total open interest to about 360,000 contracts.

Indeed, put options remain unusually active across all strikes and

expirations listed for Bank of America.

In the latest round of allegations against the bank company, Pimco,

BlackRock (BLK), and the Federal Reserve Bank of New York have essentially

accused Bank of America of selling them $47 billion of mortgage-backed

securities laden with enough bad mortgages to diminish the profitability of the

investments. (For one analyst's take on this situation, see the second item in

this week's Market Watch sampling, page M11.)

True or not, such accusations are taken seriously in the markets because

institutional investors always fear banks use their advantages as major dealers

who control the markets to unload bad financial products that they themselves do

not want to inventory. Even worse, this accusation against Bank of America

resurrects lingering investor fears that Bank of America's 2008 purchase of

Countrywide Financial for $4.1 billion has coupled the fortunes of the

Charlotte, N.C., bank to a hard-to-evaluate financial mess.

While initial media reports indicate that BofA has been asked to buy back

up to $47 billion in mortgage securities, a person close to the money managers

said that was premature. "We want to know if improper loans were securitized,"

this person said. "At this point, it is just basic due diligence."

So far, BofA has reportedly rebuffed requests that it repurchase the

securitized mortgages. But that counts for little in the markets. Until the

matter is settled, Bank of America will trade like a litigation stock. News

headlines will heavily influence options and stock trading. The next few weeks

could be tough even if the speculators playing for a snapback in the stock price

manage to make some money.

In the parlance of trading, Bank of America has "headline risk." The stock

will make sharp moves in reaction to the headlines on news stories. And the

headlines will come. The banking industry is accused of relying on shoddy home-

foreclosure practices. Congress is planning hearings, which many in the markets

know -- often from personal experience -- are little more than populist witch-

hunts good for intraday trading volatility.

Inquiries with much more impact could come in the form of investigations

by state attorneys general trying to determine if mortgage lenders violated

state laws.

Already, many sophisticated investors have reached a guilty verdict on

Bank of America as evidenced by unusually robust trading in Bank of America's

bearish options. On Tuesday, when the bank reported disappointing earnings,

1.027 million options, or more than three times average daily volume, traded. On

Wednesday, trading volumes remained 1.6 times normal and investor pessimism was

still robust, suggesting that Mortgagegate still compels more investors and

traders to prepare for Bank of America's stock to continue to slide down the

proverbial slope of hope reserved for Wall Street's most troubled companies.

Bank of America's stock has declined 22% this year, compared with a 9%

decline for JPMorgan Chase (JPM) and a 24% gain for Citigroup (C), the financial

sector's former problem child.

With Bank of America's stock trading at a 52-week low, investors continue

to stockpile defensive put options that will increase in value if BofA's stock

falls further. The November $10 and $12 puts remain widely held, and in

demand. Investors are defraying the price of buying puts by selling bullish

calls. They are using money received from selling calls -- an indication the

stock is not expected to rise -- to buy bearish puts.

---

Friday, October 22, 2010

Large Put buying in BAC - still swinging short from 12

[13:42] ben3092000: someone bought 120k nov 10 puts in BAC

[13:42] ben3092000: today

[13:42] ben3092000: wow

[13:42] ben3092000: today

[13:42] ben3092000: wow

Thursday, October 21, 2010

Wednesday, October 20, 2010

GDX sets up a multi level trade

GDX sets up a nice entry for a swing, investing, or an intra-day trade. Nice gap remaining unfilled above on its daily with steady up-trending moving averages.

Tuesday, October 19, 2010

Shorting BAC here at 12, Looking for lower lows.

Short BAC at 12, looking foe lower lows. Arguments: -Weekly Chart is extremely compelling - relative Weakness - Intra day weakness and compression - UNCERTAINTY News - Suit alleges failures by Countrywide to properly service loans. Pimco and Black-rock are part of the consortium with the NY Fed. Unclear how much of this has already been anticipated by -Trends Traps Tradeable |

Today's Earnings:

Earnings

Before the Open: AOS, AEP, ASTE, BAC, BK, KO, DPZ, EMC, FRX, GS, HOG, ITW, JNJ, LAB, LMT, MNI, MTG, MICC, NYT, OXY, OMC, PH, BTU, PII, STT, SVU, UNF,UNH, WFT. After the Close: ALTR, BMI, BBND, BSX, CREE, FSII, FULT, GILD, HBHC, HA, HUBG, ISRG, JNPR, MANH, MRTN, PNFP, RCRC, SLM, SONC, SYK, TPX, TUP, URI, WCN, WDC, YHOO.

Monday, October 18, 2010

BIDU - Today's "A" move trade for 2 points

BIDU entries were at 99.60. Exits were at r1pivot at 100.64 and Fridays highs for a second partial sell at 101.64.

Arguments:

Relative Strength

par level 100 above

Trends traps trade ability

Sector Strength QQQQ's high flier

Arguments:

Relative Strength

par level 100 above

Trends traps trade ability

Sector Strength QQQQ's high flier

Sunday, October 17, 2010

Barron's(10/18) Dueling Views Of Florida's St. Joe

Investing doesn't get more dramatic than it did Wednesday at the Value

Investing Congress in New York, where hedge-fund manager David Einhorn took

apart the St. Joe Company in 139 slides. Before his speech had even ended,

shares in the Florida real-estate developer (ticker: JOE) were down 10% from

their opening price of 24.71. They ended the week at 20.56, giving St. Joe a

market value of $1.9 billion -- $370 million less than when he started

talking.

At a May 2008 conference, Einhorn famously made the bear case on Lehman

Brothers, which rose five bucks afterward. So, this time, he brought more

evidence, including photos and video showing the company's properties were "

ghost towns." The best stuff has been sold, he said, and any "further

development destroys value."

Einhorn argued that St. Joe should write down the value of three

developments carried on the books at $280 million, but which his Greenlight

Capital values at less than $40 million. St. Joe shares aren't worth much more

than 10 bucks, at best, he asserts.

Florida's real-estate calamity has dashed bullish dreams for St. Joe, as

well as Barron's positive stories written in 2004, 2008 and 2010. The last piece

(" Fairholme, Sweet Fairholme," Jan. 18, 2010), penned when the stock was at 30,

profiled Bruce Berkowitz, whose Fairholme Capital Management is St. Joe's

biggest investor. On the day of Einhorn's broadside, Berkowitz added 135,600

shares to his funds' holdings; they now own 29% of the stock. Berkowitz also

filed with regulators, signaling he wants to work with the company to increase

shareholder value. "We would love to own 100%, if possible," he told Barron's.

On Friday, St. Joe declined to comment.

Einhorn told his audience that he had tried to communicate with St. Joe

and Berkowitz, but was ignored. Berkowitz says a debate would be of no benefit

to his mutual funds' investors. Instead, he says St. Joe should host a meeting

for investors, showing them the attractive properties Einhorn left out. He plans

to review the slide show in detail, and thinks it should be brought to the

attention of Florida's governor and U.S. senators. "We must be talking about a

different place," he says.

Berkowitz says observers might find Einhorn's reality is right in the

short term, , and Fairholme's is right in the long term. "We're not in a rush,"

he says. "It's real estate. It's not going anywhere."

If only that were true of the stock.

Investing Congress in New York, where hedge-fund manager David Einhorn took

apart the St. Joe Company in 139 slides. Before his speech had even ended,

shares in the Florida real-estate developer (ticker: JOE) were down 10% from

their opening price of 24.71. They ended the week at 20.56, giving St. Joe a

market value of $1.9 billion -- $370 million less than when he started

talking.

At a May 2008 conference, Einhorn famously made the bear case on Lehman

Brothers, which rose five bucks afterward. So, this time, he brought more

evidence, including photos and video showing the company's properties were "

ghost towns." The best stuff has been sold, he said, and any "further

development destroys value."

Einhorn argued that St. Joe should write down the value of three

developments carried on the books at $280 million, but which his Greenlight

Capital values at less than $40 million. St. Joe shares aren't worth much more

than 10 bucks, at best, he asserts.

Florida's real-estate calamity has dashed bullish dreams for St. Joe, as

well as Barron's positive stories written in 2004, 2008 and 2010. The last piece

(" Fairholme, Sweet Fairholme," Jan. 18, 2010), penned when the stock was at 30,

profiled Bruce Berkowitz, whose Fairholme Capital Management is St. Joe's

biggest investor. On the day of Einhorn's broadside, Berkowitz added 135,600

shares to his funds' holdings; they now own 29% of the stock. Berkowitz also

filed with regulators, signaling he wants to work with the company to increase

shareholder value. "We would love to own 100%, if possible," he told Barron's.

On Friday, St. Joe declined to comment.

Einhorn told his audience that he had tried to communicate with St. Joe

and Berkowitz, but was ignored. Berkowitz says a debate would be of no benefit

to his mutual funds' investors. Instead, he says St. Joe should host a meeting

for investors, showing them the attractive properties Einhorn left out. He plans

to review the slide show in detail, and thinks it should be brought to the

attention of Florida's governor and U.S. senators. "We must be talking about a

different place," he says.

Berkowitz says observers might find Einhorn's reality is right in the

short term, , and Fairholme's is right in the long term. "We're not in a rush,"

he says. "It's real estate. It's not going anywhere."

If only that were true of the stock.

Barron's(10/18) The Trader: Stocks Post Slight Gain As Bank Shares Tumble Oct 16 at 00:09

(From BARRON'S)

Stock-market indexes rose modestly last week, as a rally in technology and

transportation stocks offset sharp declines in financials, particularly the

banks, which were dragged down by further worries about the housing bust.

The Dow Jones Industrial Average added 56 points over the five trading

sessions to end at 11,062.78. The S&P 500 tacked on 11 points to end at 1176.19,

while the Nasdaq, the week's best performer, rose 66.86 points, to 2468.

Technology shares enjoyed a banner day Friday after Google's strong

earnings report helped propel the Internet advertising company's stock (ticker:

GOOG) 11% in the session. Not far behind were Apple's shares (AAPL), which added

7% on the week.

Federal Reserve Chairman Ben Bernanke confirmed in a speech Friday that

the central bank has every intention of trying to force down interest rates and

juice the economy by purchasing Treasuries for the Fed portfolio. Expectations

of such a move have helped propel industrial and other economically sensitive

shares.

Offsetting the optimism were the financials, which can't seem to shake the

sins of years past. Fears that the banks will be forced to repurchase billions

of dollars of improperly documented loans that typically were sold through

securitizations hurt shares in the industry. In addition, the banks' improper

documentation of many loan foreclosures has attracted scrutiny from the state

attorneys general and the Office of the Comptroller of the Currency.

Bank of America (BAC) shares dropped 11% to 11.98 on the week, while

JPMorgan Chase (JPM) and Citigroup (C) lost roughly 5% each. All told, the 25

largest banks lost roughly $57 billion of their market capitalization just in

the past three trading sessions, estimates Jason Goldberg an analyst at Barclays

Capital.

While the headlines were dominated by scary tales of improper foreclosure

documentation, this problem, at least, seems manageable. The banks might have to

amend the documents and could face lawsuits, but the documents in question

generally involve customers who haven't been paying their mortgages. Loans that

were improperly originated and often sold into securitizations in years past

might prove a thornier and more expensive problem. If investors can prove that

the loans were improperly originated, they can force the banks to repurchase

them.

JPMorgan disclosed last week in its quarterly earnings announcement that

it had boosted its mortgage-repurchase reserve by $1 billion, to a total of

$3 billion. It took $500 million in losses in the latest quarter due to the

repurchases, says Goldberg. Even so, the bank still made north of $4 billion

in the quarter and turned in $1.01 in earnings per share, above the 90-cent

consensus.

The subject is sure to stay in the headlines this week as both Bank of

America and Citibank report earnings. Calculating how much the banks might have

to pay to repurchase improperly originated mortgages is anyone's guess, and

estimates vary widely. One hedge fund, Branch Hill Capital, has estimated that

Bank of America alone might have to repurchase $74 billion of loans. Barclays'

Goldberg, doing a back-of-the-envelope estimate, comes up with a potential $10

billion shortfall for the whole industry, after adjusting for the taxes and

existing reserves.

In a recent interview with Bloomberg discussing both the foreclosure and

mortgage-repurchase issues, Barbara Desoer, head of Bank of America's home

lending, said, "The facts about the potential costs to the banks are grossly

distorted."

Given the $57 billion in lost market share that the banks suffered last

week, the problem looks to be more than priced into the market.

Transportation stocks are chugging along nicely this year, with the Dow

Jones Transportation Average up almost 15%, approaching its spring high. It got

a nice boost last week after CSX (CSX) reported that quarterly earnings rose 43%

from a year ago, beating analysts' expectations. CSX shares jumped 3.6% to 59.54

during the week, and Norfolk Southern (NSC) came along for the ride, rising

1.6%.

Gains haven't been limited just to the railroad sector. FedEx (FDX) shares

are up 25% since bottoming in July and CH Robinson Worldwide (CHRW), a logistics

company, has enjoyed a 40% rally from its February lows.

"These companies all do very well when the economy is growing," says Ed

Yardeni, president & chief investment strategist at Yardeni Research. They're

also benefitting from a boom in the transportation of agricultural products and

imports.

Market bulls should take comfort from the transports' rally, as Dow Theory

posits that when stocks of the companies that make products (the industrials)

and stocks of the companies that move products (the transports) are both doing

well, it's a positive sign for the broader market, explains Louise Yamada of LY

Advisors. Yamada believes we're in a cyclical bull market.

That said, Richard Russell, editor of the Dow Theory Letters, is bearish

despite the positive signals from the Dow transports. Stock valuations are

stretched and dividend yields are paltry, he says, noting "the valuation is

characteristic of a top." Russell is investing in gold.

But it's hard to ignore CSX's experience in the trenches, where unit

volume grew 10%, and revenue 16% in the third quarter. While the company

acknowledged that shipments related to housing are dormant, shipments of coal,

agricultural and automotive products, and chemicals are strong.

Executives see that strength continuing. CSX forecasts that U.S.

industrial production will rise 4.9% in the fourth quarter, and management sees

"good, slow steady growth" for the whole economy next year. Rick Paterson, an

analyst at UBS, has an above-consensus 2011 earnings estimate of $5 a share.

He rates CSX a Buy, with a 12-month price target of 80.

If CSX is right, that's good news not just for the company's shareholders

but the stock market generally.

Some of last week's best-performing stocks were targets of acquisitions.

King Pharmaceuticals (KG) agreed to be purchased by Pfizer (PFE) for $3.6

billion in cash. Its shares soared 37%.

Yahoo! (YHOO) benefited from rumors it might get a bid from private-equity

outfits and AOL (AOL), which sent Yahoo! shares up 12% on the week. Western

Digital (WDC) rose 10% even though the company never even got a buyout offer.

But rival Seagate Technology (STX) soared on hopes that a private-equity firm

might make a deal.

Deal activity is about 20% higher so far this year, at $584 billion,

than in the same stretch of 2009. Richard Peterson, a director at Standard &

Poor's, expects deal volume to finish the year at $800 billion, far below a

peak of $1.4 trillion in 2007, but sharply higher than last year's $692

billion.

"The takeaway from the M&A [merger and acquisition] activity is that

stocks are too cheap," says Jerry Harris, president and market strategist at

Sterne Agee Asset Management in Birmingham, Ala.

---

VITAL SIGNS

Friday's Week's Week's

Close Change % Chg.

DJ Industrials 11062.78 +56.30 +0.51

DJ Transportation 4694.78 +66.39 +1.43

DJ Utilities 406.23 +2.32 +0.57

DJ 65 Stocks 3841.33 +30.40 +0.80

DJ US Market 294.20 +2.95 +1.01

NYSE Comp. 7520.60 +42.18 +0.56

Amex Comp. 2100.63 +29.48 +1.42

S&P 500 1176.19 +11.04 +0.95

S&P MidCap 819.76 +8.39 +1.03

S&P SmallCap 373.82 +6.19 +1.68

Nasdaq 2468.77 +66.86 +2.78

Value Line (arith.) 2593.15 +32.26 +1.26

Russell 2000 703.16 +9.34 +1.35

DJ US TSM 12326.75 +130.55 +1.07

Last Week Week Earlier

NYSE

Advances 1,821 2,202

Declines 1,318 948

Unchanged 55 46

New Highs 634 518

New Lows 22 24

Av Daily Vol (mil) 4,793.9 4,155.3

Dollar

(Finex spot index) 77.04 77.33

T-Bond

(CBT nearby futures) 126-08 127-10

Crude Oil

(NYM light sweet crude) 81.25 82.66

Inflation KR--CRB

(Futures Price Index) 296.06 295.11

Gold

(CMX nearby futures) 1371.10 1344.20

Stock-market indexes rose modestly last week, as a rally in technology and

transportation stocks offset sharp declines in financials, particularly the

banks, which were dragged down by further worries about the housing bust.

The Dow Jones Industrial Average added 56 points over the five trading

sessions to end at 11,062.78. The S&P 500 tacked on 11 points to end at 1176.19,

while the Nasdaq, the week's best performer, rose 66.86 points, to 2468.

Technology shares enjoyed a banner day Friday after Google's strong

earnings report helped propel the Internet advertising company's stock (ticker:

GOOG) 11% in the session. Not far behind were Apple's shares (AAPL), which added

7% on the week.

Federal Reserve Chairman Ben Bernanke confirmed in a speech Friday that

the central bank has every intention of trying to force down interest rates and

juice the economy by purchasing Treasuries for the Fed portfolio. Expectations

of such a move have helped propel industrial and other economically sensitive

shares.

Offsetting the optimism were the financials, which can't seem to shake the

sins of years past. Fears that the banks will be forced to repurchase billions

of dollars of improperly documented loans that typically were sold through

securitizations hurt shares in the industry. In addition, the banks' improper

documentation of many loan foreclosures has attracted scrutiny from the state

attorneys general and the Office of the Comptroller of the Currency.

Bank of America (BAC) shares dropped 11% to 11.98 on the week, while

JPMorgan Chase (JPM) and Citigroup (C) lost roughly 5% each. All told, the 25

largest banks lost roughly $57 billion of their market capitalization just in

the past three trading sessions, estimates Jason Goldberg an analyst at Barclays

Capital.

While the headlines were dominated by scary tales of improper foreclosure

documentation, this problem, at least, seems manageable. The banks might have to

amend the documents and could face lawsuits, but the documents in question

generally involve customers who haven't been paying their mortgages. Loans that

were improperly originated and often sold into securitizations in years past

might prove a thornier and more expensive problem. If investors can prove that

the loans were improperly originated, they can force the banks to repurchase

them.

JPMorgan disclosed last week in its quarterly earnings announcement that

it had boosted its mortgage-repurchase reserve by $1 billion, to a total of

$3 billion. It took $500 million in losses in the latest quarter due to the

repurchases, says Goldberg. Even so, the bank still made north of $4 billion

in the quarter and turned in $1.01 in earnings per share, above the 90-cent

consensus.

The subject is sure to stay in the headlines this week as both Bank of

America and Citibank report earnings. Calculating how much the banks might have

to pay to repurchase improperly originated mortgages is anyone's guess, and

estimates vary widely. One hedge fund, Branch Hill Capital, has estimated that

Bank of America alone might have to repurchase $74 billion of loans. Barclays'

Goldberg, doing a back-of-the-envelope estimate, comes up with a potential $10

billion shortfall for the whole industry, after adjusting for the taxes and

existing reserves.

In a recent interview with Bloomberg discussing both the foreclosure and

mortgage-repurchase issues, Barbara Desoer, head of Bank of America's home

lending, said, "The facts about the potential costs to the banks are grossly

distorted."

Given the $57 billion in lost market share that the banks suffered last

week, the problem looks to be more than priced into the market.

Transportation stocks are chugging along nicely this year, with the Dow

Jones Transportation Average up almost 15%, approaching its spring high. It got

a nice boost last week after CSX (CSX) reported that quarterly earnings rose 43%

from a year ago, beating analysts' expectations. CSX shares jumped 3.6% to 59.54

during the week, and Norfolk Southern (NSC) came along for the ride, rising

1.6%.

Gains haven't been limited just to the railroad sector. FedEx (FDX) shares

are up 25% since bottoming in July and CH Robinson Worldwide (CHRW), a logistics

company, has enjoyed a 40% rally from its February lows.

"These companies all do very well when the economy is growing," says Ed

Yardeni, president & chief investment strategist at Yardeni Research. They're

also benefitting from a boom in the transportation of agricultural products and

imports.

Market bulls should take comfort from the transports' rally, as Dow Theory

posits that when stocks of the companies that make products (the industrials)

and stocks of the companies that move products (the transports) are both doing

well, it's a positive sign for the broader market, explains Louise Yamada of LY

Advisors. Yamada believes we're in a cyclical bull market.

That said, Richard Russell, editor of the Dow Theory Letters, is bearish

despite the positive signals from the Dow transports. Stock valuations are

stretched and dividend yields are paltry, he says, noting "the valuation is

characteristic of a top." Russell is investing in gold.

But it's hard to ignore CSX's experience in the trenches, where unit

volume grew 10%, and revenue 16% in the third quarter. While the company

acknowledged that shipments related to housing are dormant, shipments of coal,

agricultural and automotive products, and chemicals are strong.

Executives see that strength continuing. CSX forecasts that U.S.

industrial production will rise 4.9% in the fourth quarter, and management sees

"good, slow steady growth" for the whole economy next year. Rick Paterson, an

analyst at UBS, has an above-consensus 2011 earnings estimate of $5 a share.

He rates CSX a Buy, with a 12-month price target of 80.

If CSX is right, that's good news not just for the company's shareholders

but the stock market generally.

Some of last week's best-performing stocks were targets of acquisitions.

King Pharmaceuticals (KG) agreed to be purchased by Pfizer (PFE) for $3.6

billion in cash. Its shares soared 37%.

Yahoo! (YHOO) benefited from rumors it might get a bid from private-equity

outfits and AOL (AOL), which sent Yahoo! shares up 12% on the week. Western

Digital (WDC) rose 10% even though the company never even got a buyout offer.

But rival Seagate Technology (STX) soared on hopes that a private-equity firm

might make a deal.

Deal activity is about 20% higher so far this year, at $584 billion,

than in the same stretch of 2009. Richard Peterson, a director at Standard &

Poor's, expects deal volume to finish the year at $800 billion, far below a

peak of $1.4 trillion in 2007, but sharply higher than last year's $692

billion.

"The takeaway from the M&A [merger and acquisition] activity is that

stocks are too cheap," says Jerry Harris, president and market strategist at

Sterne Agee Asset Management in Birmingham, Ala.

---

VITAL SIGNS

Friday's Week's Week's

Close Change % Chg.

DJ Industrials 11062.78 +56.30 +0.51

DJ Transportation 4694.78 +66.39 +1.43

DJ Utilities 406.23 +2.32 +0.57

DJ 65 Stocks 3841.33 +30.40 +0.80

DJ US Market 294.20 +2.95 +1.01

NYSE Comp. 7520.60 +42.18 +0.56

Amex Comp. 2100.63 +29.48 +1.42

S&P 500 1176.19 +11.04 +0.95

S&P MidCap 819.76 +8.39 +1.03

S&P SmallCap 373.82 +6.19 +1.68

Nasdaq 2468.77 +66.86 +2.78

Value Line (arith.) 2593.15 +32.26 +1.26

Russell 2000 703.16 +9.34 +1.35

DJ US TSM 12326.75 +130.55 +1.07

Last Week Week Earlier

NYSE

Advances 1,821 2,202

Declines 1,318 948

Unchanged 55 46

New Highs 634 518

New Lows 22 24

Av Daily Vol (mil) 4,793.9 4,155.3

Dollar

(Finex spot index) 77.04 77.33

T-Bond

(CBT nearby futures) 126-08 127-10

Crude Oil

(NYM light sweet crude) 81.25 82.66

Inflation KR--CRB

(Futures Price Index) 296.06 295.11

Gold

(CMX nearby futures) 1371.10 1344.20

Saturday, October 16, 2010

Friday, October 15, 2010

Thursday, October 14, 2010

GOOG looking for up $50 - Post Market. Floating up ALL NASDAQ stocks...

Check out the high ticker on on the right. Its all about NASDAQ high flyers GOOG - AAPL - BIDU - RIMM

GOOG reports - old school post market up move closing in on up 40 points

abbey c from nyc: goog is floating up ALL NASDAQ stocks in the post market!!!

10/14 | 16:05 | Q-GOOG | MI | Google Bests Q3 Expectations - Advancing 6% in After-Hours

10/14 | 16:05 | Q-GOOG | DJ | Google 3Q Net Cash From Operating Activities $2.89B >GOOG

10/14 | 16:04 | Q-GOOG | DJ | Google 3Q Cost-Per-Click Increased 3% >GOOG

10/14 | 16:04 | Q-GOOG | DJ | Google 3Q Paid Clicks Up 16% >GOOG

10/14 | 16:04 | Q-GOOG | DJ | Google 3Q Capex $757M >GOOG

10/14 | 16:03 | Q-GOOG | DJ | Google 3Q Non-GAAP Operating Income $2.93B >GOOG

10/14 | 16:03 | Q-GOOG | DJ | Google Shares Jump 6% After 3Q Results >GOOG

10/14 | 16:03 | Q-GOOG | DJ | Google 3Q Co.-Owned Sites Revenue $4.83B >GOOG

10/14 | 16:03 | Q-GOOG | DJ | Google 3Q Traffic Acquisition Costs $1.81B >GOOG

10/14 | 16:03 | Q-GOOG | DJ | GOOG 3Q Earnings Alert: Thomson Reuters $6.69

10/14 | 16:03 | Q-GOOG | DJ | Google 3Q Network Rev $2.2B >GOOG

10/14 | 16:03 | ------ | CE | Large cap tech (QQQQ, NQ) seeing positive initial response to GOOG Q3 earnings

10/14 | 16:02 | Q-GOOG | DJ | Google 3Q Operating Income $2.55B >GOOG

10/14 | 16:02 | Q-GOOG | DJ | Google 3Q Net $2.17B >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q Rev $7.29B >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q Rev $7.29B >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q EPS $6.72 >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q Adj EPS $7.64 >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q EPS $6.72 >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q Rev $7.29B >GOOG

10/14 | 16:05 | Q-GOOG | MI | Google Bests Q3 Expectations - Advancing 6% in After-Hours

10/14 | 16:05 | Q-GOOG | DJ | Google 3Q Net Cash From Operating Activities $2.89B >GOOG

10/14 | 16:04 | Q-GOOG | DJ | Google 3Q Cost-Per-Click Increased 3% >GOOG

10/14 | 16:04 | Q-GOOG | DJ | Google 3Q Paid Clicks Up 16% >GOOG

10/14 | 16:04 | Q-GOOG | DJ | Google 3Q Capex $757M >GOOG

10/14 | 16:03 | Q-GOOG | DJ | Google 3Q Non-GAAP Operating Income $2.93B >GOOG

10/14 | 16:03 | Q-GOOG | DJ | Google Shares Jump 6% After 3Q Results >GOOG

10/14 | 16:03 | Q-GOOG | DJ | Google 3Q Co.-Owned Sites Revenue $4.83B >GOOG

10/14 | 16:03 | Q-GOOG | DJ | Google 3Q Traffic Acquisition Costs $1.81B >GOOG

10/14 | 16:03 | Q-GOOG | DJ | GOOG 3Q Earnings Alert: Thomson Reuters $6.69

10/14 | 16:03 | Q-GOOG | DJ | Google 3Q Network Rev $2.2B >GOOG

10/14 | 16:03 | ------ | CE | Large cap tech (QQQQ, NQ) seeing positive initial response to GOOG Q3 earnings

10/14 | 16:02 | Q-GOOG | DJ | Google 3Q Operating Income $2.55B >GOOG

10/14 | 16:02 | Q-GOOG | DJ | Google 3Q Net $2.17B >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q Rev $7.29B >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q Rev $7.29B >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q EPS $6.72 >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q Adj EPS $7.64 >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q EPS $6.72 >GOOG

10/14 | 16:01 | Q-GOOG | DJ | Google 3Q Rev $7.29B >GOOG

Wednesday, October 13, 2010

Breaking News - YHOO in motion in the post market

YHOO Reportedly, AOL and private equity firms are mulling a deal for Yahoo - WSJ citing sources

- The private equity firms include Silver Lake and Blackstone Group.

- According to the report, ... (15.25, +0.82, 5.68%) more... (related AOL GOOG MSFT DEALS )

- The private equity firms include Silver Lake and Blackstone Group.

- According to the report, ... (15.25, +0.82, 5.68%) more... (related AOL GOOG MSFT DEALS )

APOL crushed after hours

APOL Reports Q4 $1.31 v $1.26e, R$1.26B v $1.3Be

- Company is withdrawing its prior preliminary business outlook for fiscal 2011. (2011 Rev in hig... (49.50, -0.48, -0.96%) more... (related ESI COCO CECO STRA EDMC SLVN LINC )

- Company is withdrawing its prior preliminary business outlook for fiscal 2011. (2011 Rev in hig... (49.50, -0.48, -0.96%) more... (related ESI COCO CECO STRA EDMC SLVN LINC )

Tuesday, October 12, 2010

JuggernautTrading's webcam video October 12, 2010, 10:55 AM

Long DELL at 14 after the FED minutes on "DELL Maverick Capital speculates that CEO Michael Dell may bid for Dell - Fox Business"

Monday, October 11, 2010

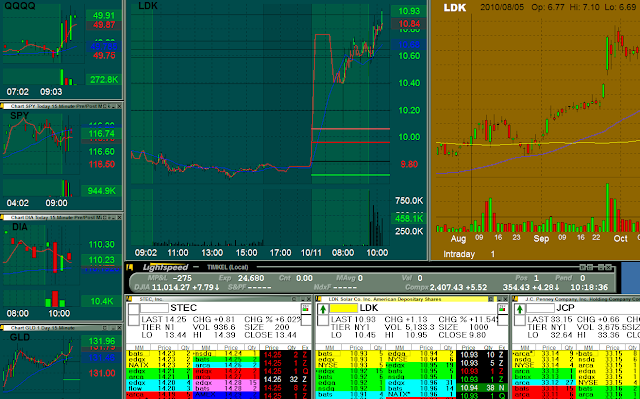

LDK looks higher

Long LDK 10.76 average

7 Arguments:

- Large Relative Strength all AM long. Both in the pre market and regular session.

-Trends Traps Tradeabilty

-Big White shoe firm giving it a significant upgrade (UBS) LDK Solar upgraded to Buy from Neutral at UBS

Oct 11 at 09:18

-Significant Earnings raise LDK Solar Raises Q3 Revenue Guidance to Above Street View -

up Nearly 10% in First Pre-Bell Matches

Oct 11 at 07:03

-Daily Breakout

Great job to all who called it out in the Juggernaut Room!

7 Arguments:

- Large Relative Strength all AM long. Both in the pre market and regular session.

-Trends Traps Tradeabilty

-Big White shoe firm giving it a significant upgrade (UBS) LDK Solar upgraded to Buy from Neutral at UBS

Oct 11 at 09:18

-Significant Earnings raise LDK Solar Raises Q3 Revenue Guidance to Above Street View -

up Nearly 10% in First Pre-Bell Matches

Oct 11 at 07:03

-Daily Breakout

Great job to all who called it out in the Juggernaut Room!

Sunday, October 10, 2010

Friday, October 8, 2010

As reported on yesterdays closing blog entry - J - C - P

JCP said to stay long overnight judging by last night price and volume action...

JCP Ticks higher on Pershing Square disclosing 16.5% stake - filing

- The Reporting Persons expect to engage in discussions with management. (31.64, 0.00, 0.00%)

JCP Ticks higher on Pershing Square disclosing 16.5% stake - filing

- The Reporting Persons expect to engage in discussions with management. (31.64, 0.00, 0.00%)

AAPL looks much higher

Long AAPL @ 290.60 in the room here on the upgrades in the pre market. OPCO analyst says 345. BAC says $400.

AAPL: Raising Target - JAGNote by Oppenheimer & Co. Inc.

Oct 8 at 07:56

Profile hits: NONE

AAPL: Raising Target - Oppenheimer & Co. has an Outperform rating and

increased its price target on the shares from $330 to $345.

AAPL: Raising Target - JAGNote by Oppenheimer & Co. Inc.

Oct 8 at 07:56

Profile hits: NONE

AAPL: Raising Target - Oppenheimer & Co. has an Outperform rating and

increased its price target on the shares from $330 to $345.

Thursday, October 7, 2010

Todays closing trades J - C - P

JCP was a great trender all PM. Compelling daily with 3 weeks of solid green bars. Strong intra day argument.

ADBE thru a higher high post 3:30 after the buyout rumer. Pending news at present so the uncertainty certainly seems to be a very strong argument here. Great job to all who profited in these strong old school type closing trades.

ADBE thru a higher high post 3:30 after the buyout rumer. Pending news at present so the uncertainty certainly seems to be a very strong argument here. Great job to all who profited in these strong old school type closing trades.

Wednesday, October 6, 2010

Tuesday, October 5, 2010

Today's Juggernaut Room Notable Trades

With a very strong market open, that broke away higher with out any fill to the downside, we were sitting on our hands mostly till 9:45. BIDU was relatively stronger than the market and presented a well rounded argument to enter long thru 99.60 on a higher intra day high. With partials that never got stopped out it provided a trend trade that continued for several points.

Ben continues to make trades for HUGE profits in the post. Tonight he hit EQIX for 2000 shares on a warn at 4:01 at 101. Covers were at the 99 and 91 level. He pulled 10 points in a few minutes on a partial. Great Job Ben.....See charts below.

Ben continues to make trades for HUGE profits in the post. Tonight he hit EQIX for 2000 shares on a warn at 4:01 at 101. Covers were at the 99 and 91 level. He pulled 10 points in a few minutes on a partial. Great Job Ben.....See charts below.

Goldman contradicts itself

GS yesterday downgrades MSFT, a dow component to neutral and a 22 target. At the same time Abbey J Cohen comes on CNBC and says the SP will trade 1200 by year end .Either there stupid or lying. One or the other, and I don't think there stupid. Its a direct contradiction imo to say 1200 sp and lower prices on MSFT at 22. we will give a updated quarterly report on our opinion on GS at year end.

Monday, October 4, 2010

Sunday, October 3, 2010

Friday, October 1, 2010

RIMM Trades Par

Rimm trades par ($50.00), still looking for $50.54 and 52 respectively on a swing trade. Great relative strength compared to the NASDAQ which was down overall on the week.

Subscribe to:

Comments (Atom)